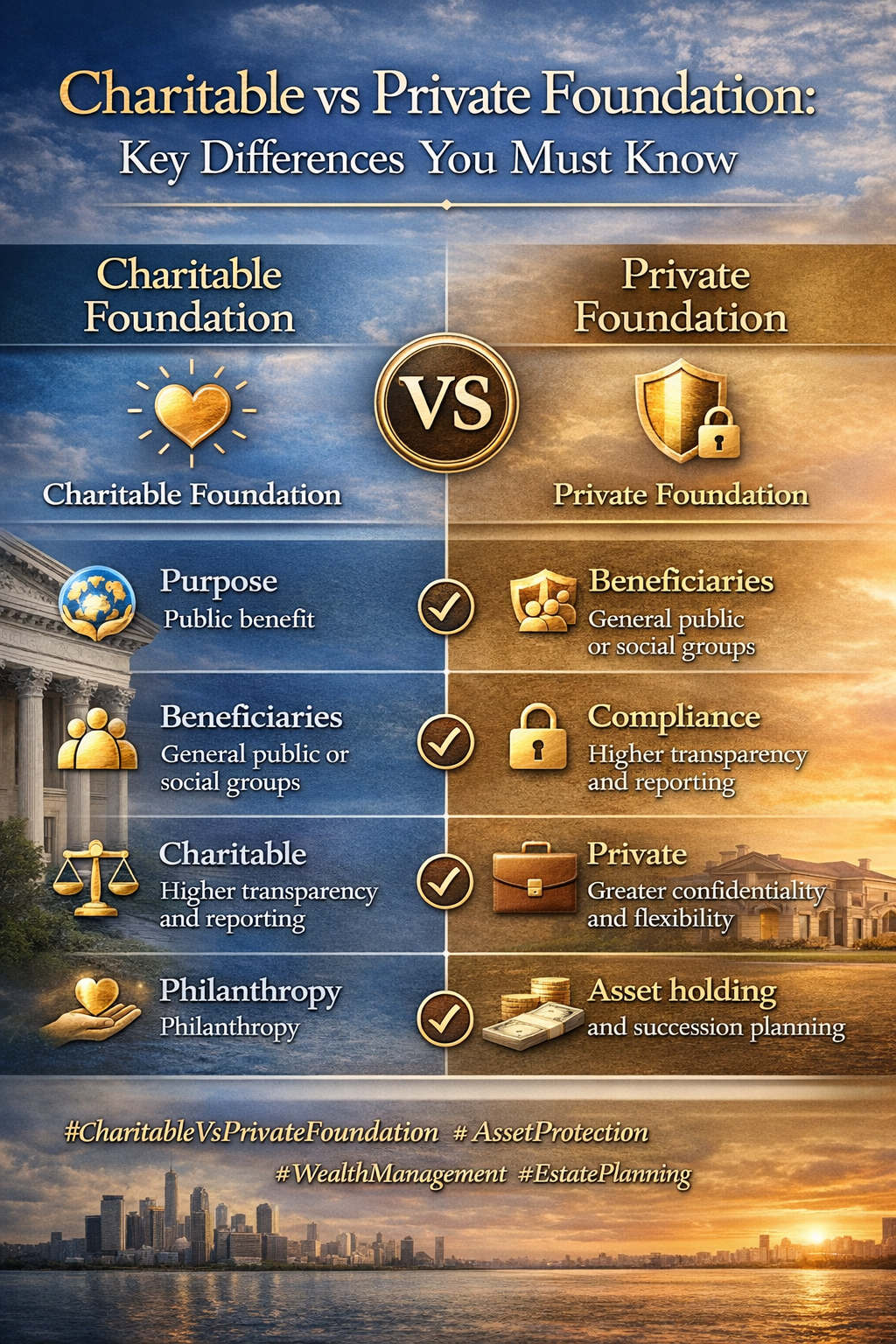

When comparing Charitable vs Private Foundation, it is important to understand that both structures serve very different purposes, even though they share similar legal features. Choosing the right foundation depends entirely on whether your goal is public benefit or private wealth management.

Charitable Foundation

A charitable foundation is created to support public or social causes such as education, healthcare, poverty relief, environmental protection, or community development. Its main objective is to benefit society rather than specific individuals. Funds and income generated by the foundation must be used strictly for charitable purposes.

Charitable foundations often operate with higher transparency and regulatory oversight. In many jurisdictions, they may receive tax advantages, but they must comply with reporting and governance requirements to maintain their charitable status.

Private Foundation

A private foundation, often known as a private interest foundation, is established to manage and protect personal or family wealth. It is commonly used for asset protection, estate planning, succession management, and holding investments.

Unlike charitable foundations, a private foundation serves named beneficiaries such as family members. It focuses on wealth preservation, privacy, and long-term financial continuity. Jurisdictions like Seychelles provide flexible legal frameworks that make private foundations attractive for international structuring.

Charitable vs Private Foundation – Main Differences

-

Purpose

Charitable → Public benefit

Private → Wealth protection -

Beneficiaries

Charitable → General public or social groups

Private → Specific individuals or family members -

Compliance

Charitable → Higher transparency and reporting

Private → Greater confidentiality and flexibility -

Primary Use

Charitable → Philanthropy

Private → Asset holding and succession planning

Understanding Charitable vs Private Foundation helps individuals and families choose the right structure based on their financial, legal, and legacy goals. While one focuses on social impact, the other is designed to protect and preserve private wealth for generations.