The Global Embedded Finance Market is rapidly transforming the financial services landscape by integrating financial products directly into non-financial platforms. Embedded finance enables businesses such as e-commerce companies, software providers, and marketplaces to embed services like payments, lending, insurance, and banking directly into their customer journeys — eliminating traditional barriers between finance and digital commerce. This seamless integration enhances customer experience, increases conversion rates, and drives revenue growth for service providers across industries.

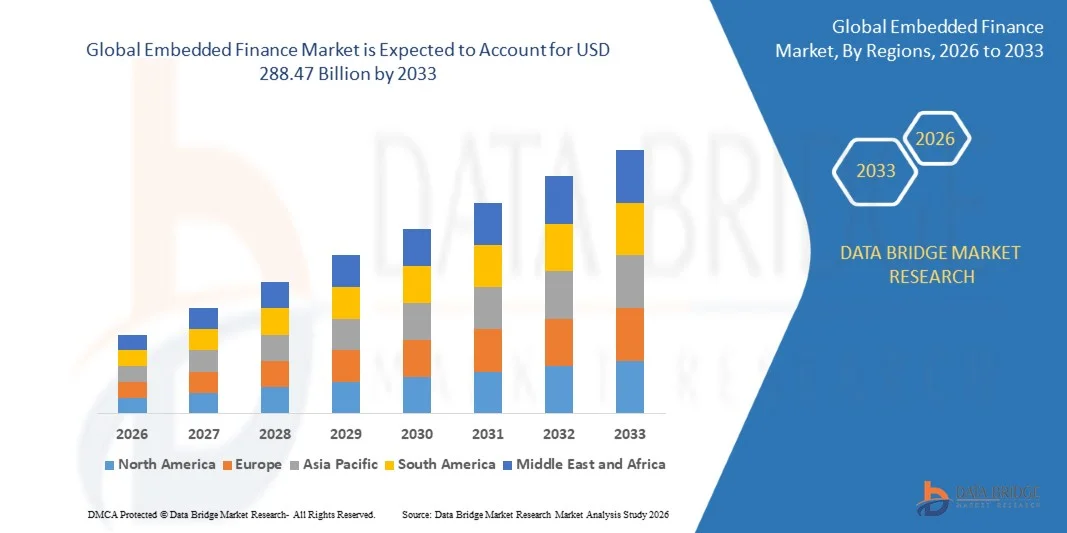

The global embedded finance market size was valued at USD 112.67 billion in 2025 and is expected to reach USD 288.47 billion by 2033, at a CAGR of 12.47% during the forecast period. Growth in this market is driven by increasing demand for personalized financial services, digital transformation across sectors, and the rise of APIs and cloud-native technologies that facilitate frictionless financial product integration.

Request a sample of “Global Embedded Finance Market” report @

https://www.databridgemarketresearch.com/request-a-sample?dbmr=global-embedded-finance-market

Market Drivers in Embedded Finance Market

One of the primary drivers of the global embedded finance market is the accelerated adoption of digital payments and e-commerce. As consumers increasingly prefer online transactions for convenience and speed, businesses are incorporating embedded payment solutions to reduce checkout friction and improve customer loyalty. Embedded finance enables a seamless transaction journey without redirecting users to external payment gateways, which boosts customer retention and revenue.

The surge in software-as-a-service (SaaS) and platform-as-a-service businesses has further fueled demand for embedded financial offerings. SaaS providers are integrating financial services — such as lending, insurance, and treasury solutions — to enhance platform stickiness and unlock new monetization streams. This trend is particularly evident in B2B platforms that want to offer credit lines and working capital solutions to SMEs directly through their interfaces.

API-driven innovation is another significant market driver. Open banking initiatives and the proliferation of fintech APIs have simplified the integration of core financial functions like KYC, risk scoring, and transaction processing into third-party platforms. This technical evolution empowers non-financial companies to incorporate financial services without building the infrastructure from scratch, reducing costs and accelerating go-to-market timelines.

Market Segmentation of Embedded Finance Market

The global embedded finance market is segmented based on type, component, deployment mode, end user, and region to capture key growth dynamics and competitive landscapes.

By Type

Embedded Payments

Embedded Lending & Credit

Embedded Insurance

Embedded Investing

Embedded Wallets

Embedded payments dominate the market due to widespread adoption in e-commerce, food delivery, travel booking, and retail sectors.

By Component

Solution

Services

Solutions accounting for the largest share include integrated payment gateways, lending platforms, and insurance modules developed through API ecosystems.

By Deployment Mode

Cloud

On-Premise

Cloud deployment leads the segment owing to scalability, rapid implementation, and lower upfront costs, making it suitable for startups and large enterprises alike.

By End User

Banking & Financial Services

Retail & Consumer Goods

Healthcare & Pharmaceuticals

Travel & Hospitality

IT & Telecom

Others

Retail and consumer goods sectors are early adopters of embedded finance solutions to improve customer engagement and purchase experience leveraging seamless checkout and buy-now, pay-later options.

Competitive Landscape

The global embedded finance market is highly competitive with participation from traditional financial institutions, fintech startups, and technology service providers. Key market players are focusing on strategic collaborations, partnerships, and acquisitions to strengthen their solution portfolios and capture new opportunities.

Traditional banks are increasingly partnering with technology platforms to offer embedded lending and payment solutions, positioning themselves against pure fintech competitors. Fintech companies, in turn, are investing heavily in API development, security, and compliance frameworks to attract large platform partners and reduce integration complexities.

Product differentiation is being driven by advanced analytics, AI-based risk assessment, and personalized financial offerings that enhance user experience. Vendors are also expanding their global footprint through regional partnerships, localized solutions, and compliance support to help businesses navigate regulatory environments.

Inquire here to explore industry-specific data @

https://www.databridgemarketresearch.com/inquire-before-buying?dbmr=global-embedded-finance-market

Emerging Opportunities

Emerging opportunities in the global embedded finance market are closely linked to the expansion of Buy Now, Pay Later (BNPL) and digital lending solutions. BNPL offerings, embedded at the point of sale across online and offline channels, are rapidly gaining popularity due to flexible payment options and consumer preference for credit availability without traditional lending barriers.

Integration of AI and machine learning in embedded finance systems is creating opportunities for personalized financial recommendations, enhanced fraud detection, and dynamic credit scoring — enabling platforms to offer tailored financial experiences to users.

The intersection of embedded finance and IoT (Internet of Things) presents another frontier. IoT-connected devices can trigger automated payments, insurance renewals, and subscription renewals, offering truly seamless financial experiences for connected consumers and businesses.

In addition, the adoption of blockchain technology and smart contracts can enhance transparency, reduce settlement times, and lower operational costs for embedded financial transactions — especially in cross-border payments and supply chain finance.

Regional Analysis

North America

North America dominates the global embedded finance market with strong fintech infrastructure, high digital adoption rates, and supportive regulatory frameworks. The U.S. leads regional demand with widespread integration of embedded payments, lending, and insurance services across digital platforms.

Europe

Europe holds a significant share driven by open banking initiatives, digital transformation in the financial sector, and the adoption of innovative financial products by retail and corporate users. Countries like the U.K., Germany, and the Netherlands are notable contributors.

Asia-Pacific

Asia-Pacific is expected to witness the fastest growth due to rising e-commerce penetration, increasing digital wallet adoption, and supportive government policies for fintech innovation. Emerging markets like China, India, and Southeast Asia are fueling this regional surge.

Latin America & Middle East-Africa

Latin America and the Middle East-Africa regions are emerging markets for embedded finance, supported by growing smartphone penetration, digital payments adoption, and financial inclusion initiatives aimed at underserved populations.

FAQs

- What is embedded finance?

Embedded finance refers to the seamless integration of financial services — such as payments, lending, insurance, or investing — into non-financial platforms, applications, or customer journeys. - What is driving the growth of the embedded finance market?

Key drivers include rising digital payments adoption, e-commerce growth, API-driven innovation, and businesses seeking enhanced customer experience through integrated financial services. - What was the market value in 2025?

The global embedded finance market was valued at USD 112.67 billion in 2025. - What is the expected market value by 2033?

It is projected to reach USD 288.47 billion by 2033, growing at a CAGR of 12.47%. - Which region is expected to grow fastest?

Asia-Pacific is projected to grow the fastest due to digital payment adoption, fintech innovation, and strong economic expansion in the region.

Access the full “Global Embedded Finance Market” Report here @

https://www.databridgemarketresearch.com/checkout/buy/global-embedded-finance-market/compare-licence

About Us

Data Bridge is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company’s aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Contact:

Data Bridge Market Research Private Ltd.

3665 Kingsway — Suite 300

Vancouver BC V5R 5W2

Canada

📞 +1 614 591 3140 (US)

📞 +44 845 154 9652 (UK)

✉️ Email: Sales@databridgemarketresearch.com

🌐 Website: https://www.databridgemarketresearch.com/