The infographic titled “What is IV Crush? Implied Volatility Crush Explained” by SteadyOptions delivers a concise and visually engaging explanation of a crucial concept in options trading—IV Crush. Targeted at both beginner and experienced traders, this infographic simplifies the mechanics of implied volatility (IV) and how its sudden drop can dramatically impact options pricing. It begins by defining Implied Volatility as the market's forecast of a stock's future price movement, which directly influences the premiums of options contracts.

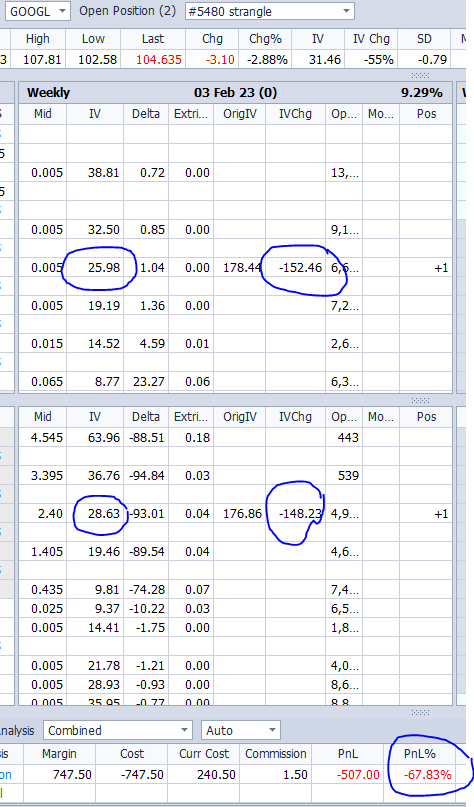

The infographic then illustrates what happens during an IV Crush, typically occurring after major events like earnings announcements. When uncertainty is resolved post-event, implied volatility often collapses—leading to a sharp drop in option values, even if the stock price moves as anticipated. Key sections include how IV Crush affects long vs. short options positions, why timing matters more than direction, and how to hedge against this phenomenon using strategies like spreads instead of outright calls or puts.

With intuitive visuals and clear explanations, this infographic is an essential resource for traders looking to understand how volatility impacts options pricing—and how to trade more effectively by accounting for IV changes.